Global Macro/Markets Notes: Week 30 | Jul 24-30, 2022

- LeoC, CFA

- Jul 24, 2022

- 6 min read

Updated: Jan 29, 2024

INSIDE

Insights, Perspectives & Trends

The Debate Goes On...

Macro/Markets Overview

FX | Rates | Credit

Equities | Alternatives

The Debate Goes On…

Welcome to another edition of our “Global Macro/Markets Notes”. As we look across currencies, bonds, equities, and commodities, we find mixed messages.

A #bearmarketrally is probably a good explanation for the results of equity markets last week. Despite the feelings of fund managers, surveyed by BofA, the facts remain that we are still in an environment of monetary tightening by the Fed and earnings revision by analysts.

Bond market participants probably smelled blood in the water, as investor ran for the safety of US treasuries.

Keep reading our notes to find out what are we thinking about all of this. I hope you enjoy this report and please let us know if you have any questions, concerns or comments that will help in the future versions of our publications.

Warm regards, LeoC.

Insights, Perspectives & Trends

The debate is on… equity and bond market rallied on the week. So, who is right? The jury still out.

If you blinked you probably missed, but don't worry, if you have a time horizon longer than a few years, it will not matter if you jumped onboard now. Said that, we believe the market action last week was not a definitive sign that we are entering a new bull market. As such, there is a possibility that you will get another chance, but don't aim to pick a bottom because you could miss the journey.

Led by traditionally bull market segments, such as small caps and tech stocks, US equities advanced. The S&P500 rose 2.5% on the week, is now 4.7% higher on the month and has recovered some lost ground on the year, but still down 16.8% in 2022. Despite plenty of bad news priced in, we don't believe this is an "all clear" signal and we are expecting further volatility in the coming weeks and months.

In prior publications, we have mentioned the obvious: after a bear market there is always a bull market, but #bearmarketrally should not be interpreted as a signal to go all in or hit the gas pedal hard. This could well be the fifth #failed attempt this year by US equites (figure 1) to change market direction; that debate is now going on…

Macro/Markets Overview

It is Monday again and we are ready to get back in the trenches. Let’s look at what is happening in the #globalmacromarkets. As mentioned, our goal is to simply try to understand the “message”, if any, that financial markets are sending through their short-term movements and dynamics. Before we begin, let us restate the obvious from last week’s notes: when we expect trouble, we run for safety…

FX | Rates |Credit

Let’s restate the obvious from last week’s notes: when we expect trouble, we run for safety.

From our #bzcFXmonitor, the US Dollar Index (BBDXY) fell 1.0% on the week. Technically, 1,260’s represents a short-term support for the #USDuptrend that began around mid-summer 2021. Except for China, the research done from our BRAG team and external partners, still suggesting that economic and inflation deceleration is not only a US phenomenon, but also a global one. As such, we continue to be bullish the USD and the late-intermediate to longer part of UST curve.

Looking at the FX pairs:

The Euro strengthened 1.3% to close the week at EUR.USD 1.0213. The ECB raised interest rates by 50bps, joining the effort to fight inflation like other major central banks. The #EURdowntrend is intact; we are looking around 1.0370 as an immediate-term line in the sand for a possible change in trend.

The British Pound rallied 1.2% to GBP.USD 1.1999 and continues #GBPdowntrend.

The Japanese Yen gained 1.8% to USD.JPY 136.12. Nevertheless, the JPY remains at a multi-decade low. The last time the JPY was this weak was around November 1998. The #JPYdowntrend is expected to continue if the Bank of Japan (BoJ) maintains its ultra-loose monetary policy, to support the country's still-fragile economic recovery, and continues to diverge from other major central banks' tightening policies.

The Chinese Renminbi ended the week pretty much unchanged at USD.CNY 6.7515 and remains on a #CNYdowntrend since the first leg of the break in April 2022 and a tentative second leg in earlier this month.

The Brazilian Real defied general USD weakness and depreciated 1.6% to USD.BRL 5.4980. The #BRLdowntrend is alive and kicking; USDBRL 5.20ish is a possible line in the sand for a change in trend.

In the #bzcFImonitor, weak economic data in the US pushed the yield on the 10yr UST down by 16.5bps to end the week at 2.7504%, while the #10_2USTspread declined further into negative territory, ending the week at -0.224%; UST yields for all maturities over 1yr moved lower on the week (figure 2).

The IG corporate bond market was active due to banks issuing new bonds after reporting earnings. Despite the uptick in supply, corporate credit spreads tightened alongside improved macro sentiment. High yield bonds traded higher along with equities amid the somewhat more stable macro backdrop. Market participants were focused on earnings results and the European Central Bank’s (ECB) first rate hike in 11 years ahead of next week’s U.S. Federal Reserve monetary policy meeting.

Core eurozone bond yields fell as concerns about economic growth drove demand for safe heavens. The release of the Eurozone Purchasing Managers’ Index (PMI), which indicated that economic activity contracted in July, did not help. UK gilt yields traded in line with core eurozone constituents. Peripheral eurozone bond yields ended the week pretty much unchanged. The Italian 10-year government bond yield rose after Prime Minister Mario Draghi’s resignation but ended the week pretty much unchanged.

The yield on the 10-year Japanese government bond finished the week at 0.22%, down from 0.23% at the end of the previous week. As mentioned above in the FX section, it was widely expected for the BoJ to maintain its ultra-loose monetary policy to support the country’s fragile economic recovery.

The People’s Bank of China maintained interest rates as expected, keeping the one-year loan prime rate (LPR[1]) unchanged at 3.70% and the five-year rate at 4.45%. The 10-year Chinese government bond yield was flat and outflows from China’s bond markets totaled USD 14 billion in June as surging U.S. Treasury yields reduced the relative attractiveness of Chinese bonds, reported Bloomberg.

[1] The LPR is a lending reference rate set monthly by 18 banks and announced by the central bank. Banks use the five-year LPR to price mortgages, while most other loans are based on the one-year rate.

Equities | Alternatives

For our #bzcEQmonitor, bad news for main street triggered short covering on wall street.

US investors appeared to welcome signs of a slowing economy and decreasing inflationary pressures. Led by traditionally bull market segments, such as small caps and tech stocks, US equities carried over the momentum from the day after the bad US CPI report and is now 4.5% higher since then.

For the week, global equities ended higher. The MSCI ACWI rose 3.2%; the S&P500 rose 2.5%, is now 4.7% higher on the month, and has recovered some lost ground on the year, but still down 16.8% in 2022. Consumer discretionary led gains within the S&P 500 Index, helped by a rebound in AMZN and TSLA, while the typically defensive health care and utilities sectors lagged. Weakness in VZ and GOOG negatively impacted the communication services sector.

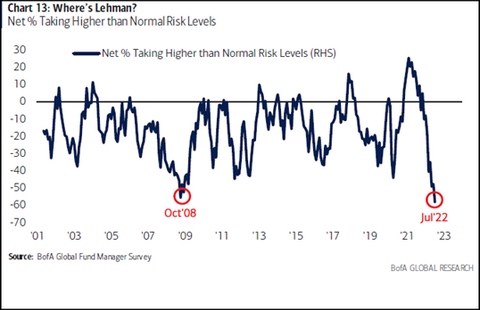

On Tuesday (July 19), the S&P500 rallied almost 2.8%, as market participants digested the BofA Monthly Fund Manager Survey and speculated that negative sentiment had reached extreme and unsustainable levels, triggering short covering from investors who were betting that stocks would go down more. The CFTC report for this week will confirm or deny the suspicion.

In summary, the survey showed that funds’ cash holdings had reached their highest levels since 9/11, while their equity exposure was at the lowest levels since the recession and global financial crisis of 2007–2009. A record number of fund managers also reported taking on lower-than-normal risk. Despite plenty of bad news priced in, we don't believe this is an "all clear" signal and we are expecting further volatility in the coming weeks and months.

In Europe equities rose as market sentiment remained strong despite a series of discouraging economic data releases and the ECB decision to raise interest rates for the first time in over a decade. The STOXX Europe 600 Index ended the week 2.88% higher, Germany (DAX) rose 3.0%, France (CAC 40) increased 3.0%, Italy (FTSE MIB) was up 1.3%, and the UK (FTSE 100) ended the week 1.6% higher.

In Asia, Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining 4.20% and the broader TOPIX Index up 3.35%. The Chinese stock markets posted mixed returns after Premier Li Keqiang tempered expectations of excessive stimulus and indicated flexibility on China’s annual growth target. The broad, capitalization-weighted Shanghai Composite Index added 1.3% and the blue-chip CSI 300 Index, which tracks the largest listed companies in Shanghai and Shenzhen, decreased 0.2%.

On the regulatory front, China’s cybersecurity regulator fined Didi Global CNY 8 billion (USD 1.2 billion), potentially signaling an end to the government’s crackdown on the ride-hailing app and clearing a path for a public listing in Hong Kong. Didi was one of the most high-profile targets of Beijing’s clampdown on the country’s internet industry starting in 2020, when regulators unexpectedly canceled the initial public offering of Ant Group.

Lastly, the #bzcCMDmonitor rebounded. The broad-based BCOM Index gained 2.7% on the week, as industrial metals (BCOMINTR) added 6.35%, partially offset by a 2.7% loss in agriculture index (BCOMAGTR). Oil prices saw volatile swings last week amid multiple factors: returning Libyan supplies, increasing recession risks, fears of renewed China lockdowns, and a slower US summer driving season. In the end, WTI declined another 3.0% to end the week at $94.70/barrel, but Brent ended the week higher at $103.20.

Nickel bounced 14.3% and copper gained 3.5%.

Comments