Navigating Global Capital Markets: Midyear 2022 Investment Outlook

- LeoC, CFA

- Jul 20, 2022

- 9 min read

Updated: Aug 9, 2022

INSIDE

Macro/Markets Conditions

GDP, Rates, Policy

Positioning

SAA and TAA

Scenario Analysis

Base, Bear, Bull Cases

Timely Topics

Inflation and Recession

Paradigm Shift

Welcome to another edition of our quarterly “Navigating Global Capital Markets”. As we enter Q3 of 2022, heavy losses have accumulated in global equities and fixed income markets. On one hand, the recovery from the impact of COVID-19 still moving forward. On the other hand, global inflationary pressures from unprecedented monetary policy incentives to fight the global pandemic, which have been further exacerbated by the four-month long Russia/Ukraine war and the Chinese zero COVID policy, have rattled the world.

As a result, over 80 central banks have turned hawkish in 2022 (figure 1), with the U.S. Federal Reserve so far raising the target range for fed funds by 1.50% (0.75% in the last meeting alone) to finish the 1H2022 at 1.75%.

The high inflation/high interest rates combo resulted in rising U.S mortgage rates, which together with fiscal restraint, a strong USD, depressed consumer sentiment and financial market losses in equities and fixed income, have been raising the expectations that a global economic deceleration could turn into a recession.

Looking ahead, valuations are obviously much more attractive than they have been during the last 12 months or so. Nevertheless, the risk of global economic deceleration, and even a recession, has been much more real.

When Navigating Global Capital Markets, we must first attempt to understand where we are and what is the investment landscape, to try to figure out where we are going. In this quarterly publication our focus is to give you an insight on our thinking and positioning ahead of expected events and conditions. For such, we rely on the Growth and Inflation Matrix together with an assessment of employment, monetary and fiscal policy conditions to guide us towards rational instead of emotional thinking.

I hope you enjoy reading this publication as much as I enjoyed putting it together and please let us know if you have any questions or comments.

Warm regards, LeoC.

Macro/Markets Conditions

Market volatility has picked up of late as investors assess the outlook for global growth, inflation, and policies (monetary + fiscal). The first half of the year was marked by the impact of the conflict between Russia and Ukraine, surging energy prices and hawkish central banks beginning to fight inflationary pressures without triggering a global recession. This macroeconomic environment left investors with no place to hide, with equities and fixed income undergoing significant drawdowns, and unsure on how to best put their money to work for them.

For the second half of the year, all eyes will be on inflation expectations and probabilities of recession. There is a growing danger that the U.S. (and other countries) could slip into recession later this year. Proprietary data and analysis from our independent partners and our own Brazen Research and Analysis Group (BRAG), show decelerating economic growth and inflation as early as August 2022. A macro/market regime where economic growth is decelerating while inflation either accelerates or decelerates is typically very volatile and full of surprises.

Higher energy and food prices are the equivalent of a tax on the consumer; rising interest rates means that positive equity returns must be supported by earnings growth; and sticky inflation will force the Fed to push interest rates higher and increase the cost of capital. It is crucial to understand whether these key risks will cause a shallow slowdown, to the likes of a technical recession, or push major economies into full‑blown recessions, dragging down corporate earnings and the profit cycle. If inflation has already peaked, a material repricing of the inflation consensus would provide a relief rally for markets and some breathing room for the Fed.

GDP and its components

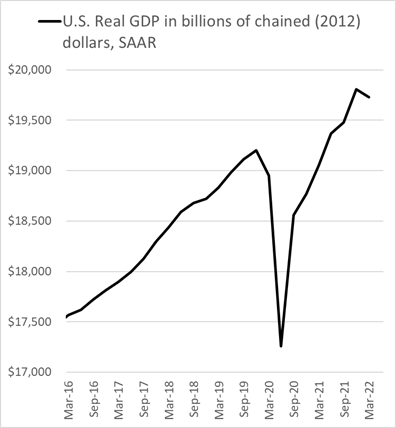

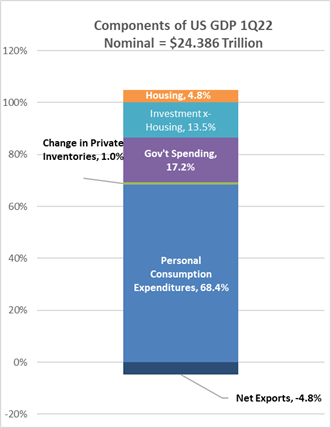

While U.S. real GDP declined 1.6% during Q1 (figure 2), recent data suggests a small rebound during Q2 with the Omicron variant subsiding and spending picking up in economic sectors battered by the pandemic such as the consumer discretionary (travel, restaurants, leisure, and entertainment).

Rates

Unfortunately, higher interest rates are starting to have an impact on the housing sector as benchmark 30-year mortgages rates have increased dramatically from just under 3.0% in early 2021 to over 6.0% recently (figure 3).

Higher interest rates have also lifted the value of the U.S. dollar against a basket of trade-weighted foreign currencies by more than 7% this year. As such, the U.S. trade balance is set to be a further drag on GDP.

Policy

Lastly, with U.S. fiscal policy incentives – such as stimulus checks, benefits, and credits – set to either completely disappear or at a very minimum significantly decline, we are still projecting year on year economic growth deceleration not only in the U.S., but also for most of world (figure 4).

Positioning

Strategic Allocation as of 06/15/21 and Tactical Allocation as of 07/06/2022

Our theme for 2022 has been about trimming equity overweight, which is totally different than overweighting or switching preference for fixed income. Our focus still on adding portfolio resilience and downside protection, but with inflation most likely peaking sometime during the second half of 2022, we see opportunities in sectors that have been hurt by the Fed’s lateness to raise interest rates.

For Q3, while reducing the overall risk sensitivity of the strategies by decreasing allocation to growth, high beta and low-grade credits, we are also emphasizing the value style by adding dividend-focused instruments to the portfolio.

While we expect real GDP growth to slow down, a recession is not our base case. We believe the YTD sell off in equities and bonds has contributed to tighter financial conditions and a cooling down of the economy. A material repricing of the inflation consensus would provide a relief rally for markets and some breathing room for the Fed. However, despite recent data showing some accumulation in inventory, a cooling of house prices, decelerating wage growth and auto prices, risks to the peak inflation thesis from geopolitical tensions and zero-COVID policy disruption, remain elevated.

Scenario Analysis

Base Case

Global growth will continue to decelerate given higher interest rates and the spillover effect in housing (higher mortgage rates) and consumer spending (slowing). Valuations have declined, which should provide some downside protection to global equities.

Inflationary pressure will last at least until the middle of Q3 before decelerating towards the end of Q3 and/or beginning of Q4. The Fed has done a lot of work over the past six months to reset rates higher, stabilize investor’s inflation expectations and regain credibility after the “transitory inflation” mistake.

Bear Case

Deteriorating conditions between Russia/Ukraine together with renewed restrictions and disruptions in the supply chain from China’s “Zero COVID” could stretch inflationary pressures further and force central banks (especially the Fed) to act decidedly hawkish ahead of impeding economic deceleration.

Bull Case

Inflationary pressures peak sooner than expected, which will lead to a repricing of assets from a less hawkish Fed perspective.

A friendly inflationary environment will have a positive impact on real income and postpone the slowdown in growth. In other words, this is what a soft landing would look like.

Timely Topics

The shift from inflation to recession fear

Mainstream financial media works like a Swiss watch!!! Now that global financial markets have officially entered bear market territory, financial news outlets, blogs and social media influencers are starting to scream RECESSION AHEAD.

Where were them three or so months ago?

If we end up in a recession, it will surely be the most widely predicted one we have ever seen. There are plenty of “macro experts” with their smartphones shouting trouble ahead, but funny enough most market participants were caught on this drawdown as they’ve listened to the Fed’s promise that inflation was transitory and interest rates would be lower for longer (#fauxpas).

Said that, barring escalating geopolitical tension between Russia and Ukraine (as well as between the U.S. and China over Taiwan) and extreme lockdown measures in China due to their #ZEROCOVID policy, the worst of inflation is very likely behind us. Quantitative tightening is shrinking money supply and financial markets have been doing part of the monetary tightening job of central banks.

Certainly, it is hard for market participants to stay focused on facts in a world full of opinions and plenty of noise. There are undisputable signs of slowing in parts of the economy, but currently it is easier to disregard some positive aspects that are persisting. Although the U.S. economy is not as good as we would like, it is better than most people think or hear from media outlets. For example, global exports remain healthy, labor markets still strong and credit markets continue to be functioning. Furthermore, consumer and industrial demand still robust and there are signs that inflation is indeed peaking. Looking ahead, our research suggests that “we will see” the other side of the inflation and recession fears as markets tend to bottom ahead of fundamentals.

As painful as it is to lose money or to give back unrealized gains, keep in mind that economic downturns are a natural part of the business cycle, but over time innovation and productivity gains tend to lead corporate earnings and market returns higher. Bear markets are not fun, but they are a healthy part of “positive destruction” and offer an opportunity for investors to increase the quality of holdings at more favorable prices.

As mentioned in our positioning section, while we expect real GDP growth to slow down – maybe to a shallow or even a technical recession, a full-blown recession is not our base case. Nevertheless, the current environment is a reminder for investors that the old principles of diversification and appropriate time horizon still very much in fashion.

A new playbook for a paradigm shift

After a period of steady growth and low inflation stretching from the mid-1980s until the 2008 Global Financial Crisis known as the “Great Moderation”, the combined impact of the Covid pandemic, supply-chain problems, Russia’s invasion of Ukraine, and a late response from central banks has resulted in a world of high inflation, low growth, and an increasing risk of recession. Undeniably, central bank support was critical for stability of economies and markets during both the financial crisis and the pandemic, but continuous stimulative monetary policy will lead to distortions in valuations.

Looking past the cyclical risks above, investors should be aware that global markets may have reached a structural inflection point where excess liquidity and declining interest rates are no longer a relevant driver of price appreciation (figures 7 and 8).

The Trillion Dollar Question

Is the current environment a consequence of unique circumstances, such as the pandemic, and moderation will resume soon? Or is it a reflection of a structural shift – maybe de-globalization -- that will make volatility the new reality?

We are inclined to think that higher volatility is here to stay, as a more fragmented global economy appears to have already arrived. In different ways and to different degrees, Brexit, the US-China trade war, the pandemic, and Russia’s invasion of Ukraine have moved the world away from free-market principles, toward a messier system where narrow nationalism and irritable geopolitics are very much present in trade and investment decisions.

In his last book, “Principles for dealing with THE CHANGING WORLD ORDER”, Ray Dalio from Bridgewater Associates provides a practical guide to dealing with the future based on lessons from the past and good framework to help investors build a playbook for this paradigm shift. We are applying some of his thinking into our investment decision making process.

Important Information and Legal Disclosures

The information presented is intended to report solely on the investment strategies and opportunities identified by Brazen Capital, LLC. Additional information is available upon request. Information herein is believed to be reliable but Brazen Capital, LLC does not warrant its completeness or accuracy. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all investors; if you have any doubts, you should consult your advisers. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein.

Any featured company logos or other third-party logos are service/trademarks of their respective owners. All other content is property of 2019 Brazen Capital, LLC. All rights reserved. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Brazen Capital, LLC.

--

Risks: International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. Small‑cap stocks have generally been more volatile in price than the large‑cap stocks. The value approach to investing carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may in fact be appropriately priced. Sustainable investing may not succeed in generating a positive environmental and/or social impact. Fixed‑income securities are subject to credit risk, liquidity risk, call risk, and interest‑rate risk. As interest rates rise, bond prices generally fall. Investments in high‑yield bonds involve greater risk of price volatility, illiquidity, and default than higher‑rated debt securities. In periods of no or low inflation, other types of bonds, such as US Treasury Bonds, may perform better than Treasury Inflation Protected Securities. Investments in bank loans may at times become difficult to value and highly illiquid; they are subject to credit risk such as nonpayment of principal or interest, and risks of bankruptcy and insolvency. Diversification cannot assure a profit or protect against loss in a declining market. Derivatives may be riskier or more volatile than other types of investments because they are generally more sensitive to changes in market or economic conditions; risks include currency risk, leverage risk, liquidity risk, index risk, pricing risk, and counterparty risk.

Comments